🏘 Lincoln Real Estate Investment Analysis

Executive Summary

This document provides an in-depth analysis of the real estate investment landscape in Lincoln, UK. It delves into various aspects including market trends, economic health, demographic influences, and potential rental yields. Key insights include the impact of the University of Lincoln’s student population on rental demand, fluctuations in house prices, and regional developments affecting property values. The analysis aims to offer a balanced view, highlighting opportunities for growth and potential risks, assisting investors in making informed decisions in the Lincoln real estate market.

Market Trends

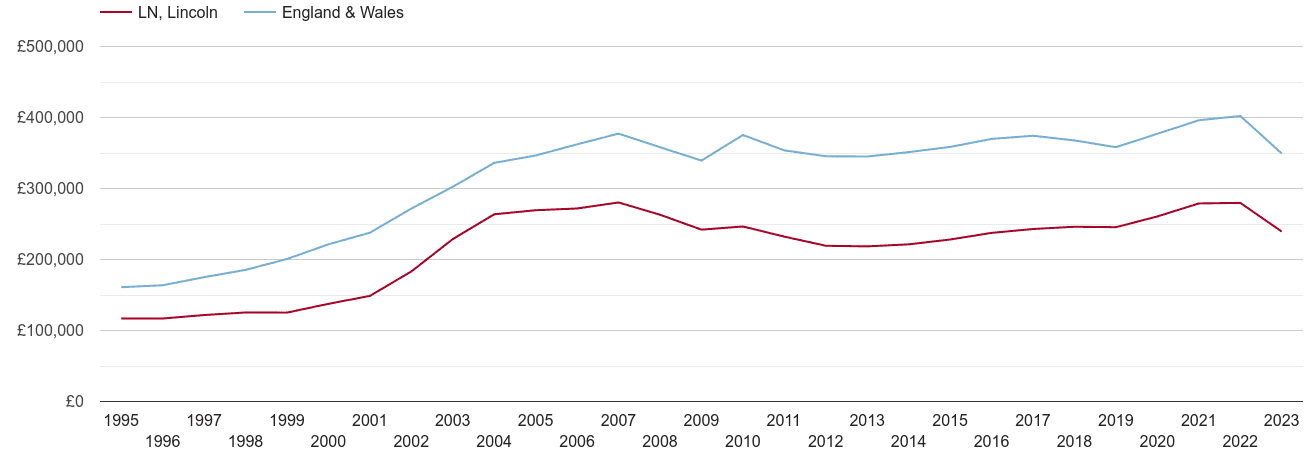

Steady house prices in Lincoln over the past few decades reflect a resilient and growing market, underpinned by consistent council investment plans. While average property prices have recently dipped to £239k, this follows a long-term upward trajectory. This stability can be attractive to investors looking for less volatile markets. Furthermore, the council’s ongoing development initiatives promise continued investment into local infrastructure, which historically contributes to property value appreciation. Such a combination of steady growth and proactive local government initiatives can bolster investor confidence in the market’s future.

For detailed historical data, please refer to the house price source.

Economic Indicators

The economic indicators for Lincoln, according to the Nomis report, show that the area has a population of 102,400 with 68.9% between 16-64 years old. Employment is strong with 83.6% of the economically active population being employed, which is higher than both the East Midlands and Great Britain averages. The unemployment rate is slightly higher than the national average at 4.6%. The city shows a diverse range of occupations with notable proportions in associate professional occupations (18.2%) and sales/customer service (25%). For a detailed analysis, visit Nomis.

University Influence

The University of Lincoln, with its substantial student population of approximately 20,500, exerts a significant impact on the local housing market. This sizeable demographic represents about 20% of the town’s population, creating robust demand for rental properties, particularly those close to the university campus. This demand can lead to a steady rental income stream for investors, especially during academic terms, and contribute to lower vacancy rates. To explore more about the university’s influence, you may visit The Complete University Guide.

Rental Yields

The rental yields in Lincoln are compelling for investors, with average long let gross yields standing at 3.5%. The city caters to a variety of tenants, including local residents, workers, and a large student population from the University of Lincoln. North Hykeham (LN6) offers a blend of residential appeal and potential growth due to its integration with Lincoln, making it a noteworthy investment area. The higher yields in LN1, close to the city centre and university, are particularly attractive for investors targeting the student market, suggesting a profitable venture for buy-to-let investments. For more in-depth insights, please refer to the Property Investments UK website.

Property Location

- Uphill: Known for its historical architecture and proximity to Lincoln Cathedral, this area is more upmarket, commanding higher property values and attracting a premium tenant base.

- Downhill: A more varied locale, Downhill offers a mix of residential and light industrial use. It tends to be more affordable, presenting opportunities for a diverse range of tenants.

- North Hykeham: As it becomes more integrated with Lincoln, North Hykeham is seen as a growing residential hub. The popularity and amenities contribute to higher property values and rental rates.

For a nuanced understanding of each area, consider visiting local properties, talking to estate agents, and researching area-specific data.

Development and Regeneration

- City Centre: The £150 million regeneration of the Waterside North area is poised to revitalize Lincoln’s city centre with new leisure amenities and homes, enhancing its appeal and potentially increasing property values.

- Western Growth Corridor: This ambitious £500 million development aims to add 3,200 new homes along with a business park and infrastructure improvements. Set to provide a substantial boost to the local economy, it may also alleviate traffic congestion, enhancing the city’s attractiveness for residents and investors alike.

These large-scale projects reflect the city’s forward-thinking approach and commitment to growth, which could have a positive impact on the real estate market.

Rental Income

The average rental price in Lincoln is £765 per calendar month (pcm), marking a notable increase of 7.4% over the previous year. This uptrend signals a robust rental market with growing income potential for landlords.

Capital Growth

In LN1, where the majority of properties reside, property values have seen a significant increase, rising by 20% in the last three years. This growth indicates a strong capital appreciation potential for investors in the area.

Council Initiatives

Lincoln City Council actively supports landlords through initiatives like the rent guarantee scheme, ensuring consistent rental income while providing quality housing solutions for the community.

Conclusion and Recommendations

Lincoln’s real estate market presents a mix of opportunities and considerations. The long-term growth in property values, coupled with the recent dip, suggests a potential for capital gains in the future. The robust student population and council initiatives, like the rent guarantee scheme, enhance rental prospects. However, due diligence in property selection is crucial, balancing yield and growth potential. The ongoing city development and regeneration projects further bolster the investment appeal. In summary, Lincoln offers a viable market for real estate investment, with careful property and location selection being key to success.

Sources

-

Plumplot - Lincoln House Prices: Plumplot Provides comprehensive data and trends on house prices in the Lincoln area.

-

Nomis - Labour Market Profile for Lincoln: Nomis Offers a detailed overview of the labour market and economic indicators in Lincoln.

-

The Complete University Guide - University of Lincoln: The Complete University Guide Information about the University of Lincoln, including student population data.

-

Property Investments UK - Lincoln Buy-to-Let: Property Investments UK Insights into the buy-to-let market in Lincoln.

-

Lincoln City Council - Advice for New Landlords: Lincoln City Council Guidelines and advice for new landlords from the local council.

-

The Lincolnite - Waterside Regeneration Plans: The Lincolnite Details about the £150 million regeneration plan for Lincoln’s Waterside area.

-

Walters Property - Buy-to-Let in Lincoln: Walters Property Analysis of the buy-to-let market in Lincoln and investment considerations.

-

Lincoln City Council - Western Growth Corridor: Lincoln City Council Information on the Western Growth Corridor development project in Lincoln.

Disclaimer

This document was compiled with assistance from OpenAI’s ChatGPT-4, an AI language model. The information and analyses provided are based on data and sources available up to early 2024. This document is intended for informational purposes and should be used as a guideline rather than a definitive investment recommendation. Readers are advised to conduct their own research and consult with professionals for specific investment advice.